How to Calculate Operating Expenses Operating expenses are a crucial aspect of any business’s financial health. Understanding and accurately calculating these expenses is vital for effective financial management and strategic decision-making. In this article, we’ll delve into the intricacies of operating expenses, explore how to calculate them, and discuss their significance in the business realm.

Operating expenses, often referred to as OPEX, are the costs incurred by a business in its day-to-day operations. These expenses are essential for running the business and generating revenue but do not include costs directly associated with production or manufacturing of goods.

Understanding Operating Expenses

Definition and Importance

Operating expenses encompass a wide range of expenditures necessary for business operations, including rent, utilities, salaries, maintenance, marketing, and administrative costs. Managing these expenses effectively is critical for maintaining profitability and sustainability.

Different Types of Operating Expenses

Operating expenses can be categorized into various types based on their nature and function. These may include rent, utilities, salaries, maintenance, marketing, insurance, taxes, and more.

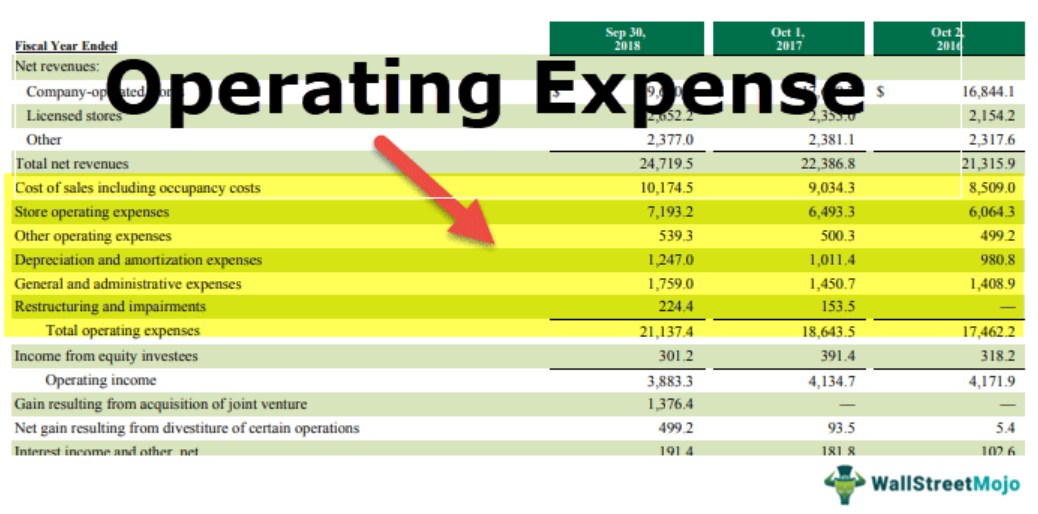

Components of Operating Expenses

Direct Costs

Direct costs are expenses directly attributable to the production of goods or services. These include raw materials, labor, and manufacturing overhead.

Indirect Costs

Indirect costs are expenses that cannot be directly tied to the production process but are necessary for overall operations. Examples include rent, utilities, and administrative salaries.

Variable Costs

Variable costs fluctuate with the level of production or sales. They may include expenses such as raw materials, direct labor, and sales commissions.

Fixed Costs

Fixed costs remain constant regardless of the level of production or sales. Examples include rent, salaries, insurance premiums, and depreciation.

How to Calculate Operating Expenses

Calculating operating expenses involves a systematic approach and thorough analysis of various cost components. Here’s a step-by-step guide to help you calculate operating expenses for your business:

Identifying and Gathering Data

Start by gathering financial data related to operating expenses from your accounting records, invoices, receipts, and expense reports. Ensure you have accurate and up-to-date information for each expense category.

Step-by-Step Calculation Process

- Identify all relevant operating expenses: List down all expenses incurred during a specific period, including rent, utilities, salaries, marketing, maintenance, and other overhead costs.

- Sum up the expenses: Add up the total amount spent on each expense category to get the total operating expenses for the period.

- Calculate average monthly expenses: Divide the total operating expenses by the number of months in the period to determine the average monthly operating expenses.

Examples and Scenarios

Let’s consider a few examples to illustrate how operating expenses are calculated in different business scenarios:

Manufacturing Business

In a manufacturing business, operating expenses may include raw material costs, labor wages, utilities, rent for the production facility, equipment maintenance, marketing expenses, and administrative salaries.

Service-Based Business

For a service-based business such as a consultancy or a law firm, operating expenses may comprise office rent, professional fees, utilities, marketing costs, software subscriptions, and employee salaries.

Retail Business

In a retail business, operating expenses could include rent for the store premises, inventory costs, employee wages, utilities, marketing and advertising expenses, insurance premiums, and taxes.

Importance of Monitoring Operating Expenses

Monitoring operating expenses is crucial for several reasons:

Impact on Profitability

Controlling operating expenses directly impacts a company’s profitability by increasing net income. By optimizing expenses, businesses can improve their bottom line and financial performance.

Financial Planning and Decision Making

Accurate tracking of operating expenses allows businesses to make informed financial decisions, allocate resources efficiently, and plan for future growth and expansion.

Strategies to Reduce Operating Expenses

Implementing cost-saving strategies can help businesses reduce their operating expenses and improve overall financial efficiency. Some effective strategies include:

Cost Control Measures

Implementing strict budgetary controls, negotiating better deals with suppliers, and eliminating unnecessary expenses can help reduce operating costs significantly.

Efficiency Improvements

Investing in technology, streamlining processes, and optimizing workflows can enhance operational efficiency and minimize wastage, leading to cost savings.

Negotiation Tactics

Negotiating better terms with vendors, renegotiating lease agreements, and exploring alternative suppliers can help lower expenses without compromising quality or service.

Common Mistakes to Avoid

When managing operating expenses, it’s essential to avoid common pitfalls that could undermine your efforts to control costs effectively:

Overlooking Small Expenses

Even seemingly insignificant expenses can add up over time and impact profitability. It’s crucial to pay attention to all expenses, no matter how small, and look for opportunities to reduce or eliminate them.

Ignoring Seasonal Fluctuations

Many businesses experience seasonal fluctuations in operating expenses. Ignoring these fluctuations or failing to plan for them adequately can lead to budgetary constraints and financial instability.

Failing to Review Regularly

Operating expenses should be reviewed regularly to identify areas for improvement and cost-saving opportunities. Failing to conduct periodic reviews can result in missed chances to optimize expenses and maximize profitability.

Conclusion

Calculating operating expenses accurately is essential for businesses to maintain financial stability, make informed decisions, and sustain long-term growth. By understanding the components of operating expenses, implementing cost-saving strategies, and avoiding common pitfalls, businesses can effectively manage their expenses and improve overall profitability.

Unique FAQs

- What are some examples of indirect operating expenses?

- Indirect operating expenses may include rent, utilities, administrative salaries, insurance premiums, and taxes.

- How often should operating expenses be reviewed?

- Operating expenses should be reviewed regularly, preferably on a monthly or quarterly basis, to identify cost-saving opportunities and ensure financial efficiency.

- Why is it essential to calculate operating expenses accurately?

- Accurate calculation of operating expenses is crucial for budgeting, financial planning, and making informed business decisions to optimize profitability.

- What are some cost-saving strategies to reduce operating expenses?

- Cost-saving strategies may include negotiating better deals with suppliers